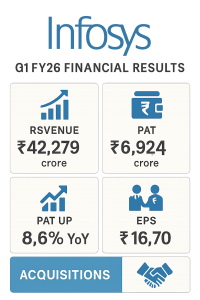

Infosys Limited, one of India’s IT giants, announced its audited financial results for the quarter ended June 30, 2025 (Q1 FY26). The results highlight stable growth in revenue, robust profitability, sustained shareholder returns, and several strategic developments.

Financial Performance Summary

Consolidated Financial Results (₹ crore)

| Particulars | Q1 FY26 (June 30, 2025) | Q4 FY25 (Mar 31, 2025) | Q1 FY25 (June 30, 2024) | FY25 (Year End) |

|---|---|---|---|---|

| Revenue from operations | 42,279 | 40,925 | 39,315 | 162,990 |

| Other income, net | 1,042 | 1,190 | 838 | 3,600 |

| Total income | 43,321 | 42,115 | 40,153 | 166,590 |

| Total expenses | 33,581 | 32,452 | 31,132 | 128,982 |

| Profit before tax | 9,740 | 9,663 | 9,021 | 37,608 |

| Profit for the period | 6,924 | 7,038 | 6,374 | 26,750 |

| Total comprehensive income | 8,037 | 7,313 | 6,341 | 27,209 |

Earnings Per Share (EPS)

| Particulars | Q1 FY26 (₹) | Q4 FY25 (₹) | Q1 FY25 (₹) | FY25 (₹) |

|---|---|---|---|---|

| Basic EPS | 16.70 | 16.98 | 15.38 | 64.50 |

| Diluted EPS | 16.68 | 16.94 | 15.35 | 64.34 |

Dividend Details

- For FY25, Infosys declared a final dividend of ₹22 per share (par value ₹5 each), approved and paid on June 30, 2025.

- The total dividend for FY25 stood at ₹43 per share (including ₹21 interim and ₹22 final dividend).

Business Segment Highlights

| Segment | Revenue Q1 FY26 (₹ crore) | Segment Profit Q1 FY26 (₹ crore) |

|---|---|---|

| Financial Services | 11,796 | 2,973 |

| Manufacturing | 6,804 | 1,416 |

| Energy, Utilities, Resources and Services | 5,742 | 1,437 |

| Retail | 5,651 | 1,691 |

| Communication | 5,097 | 880 |

| Hi-Tech | 3,296 | 768 |

| Life Sciences | 2,745 | 554 |

| All Other Segments | 1,148 | 224 |

| Total | 42,279 | 9,943 |

Financial Services continued as the top contributor to both revenue and profit, followed by Manufacturing and Energy, Utilities, Resources and Services.

Key Developments

- Acquisitions:

- On April 30, 2025, Infosys Nova Holdings LLC acquired 100% partnership interests in MRE Consulting Ltd (USA), a leading energy and business consulting firm, for up to $36 million (₹306 crore).

- On the same date, Infosys Singapore Pte Ltd acquired “The Missing Link” group—a leading cybersecurity provider in Australia—for up to AUD93 million (₹505 crore), expanding its presence in cybersecurity.

- Subsidiary Activity: Multiple mergers, dissolutions, and new incorporations occurred among group entities, reflecting active portfolio management.

- Regulatory Investigation: The U.S. Department of Justice is investigating the company’s actions concerning the classification of certain H-1B visa employees. Infosys has commenced an internal inquiry and is cooperating with authorities. The company currently cannot predict the outcome or its impact on operations.

Auditor’s Opinion

The statutory auditors, Deloitte Haskins & Sells LLP, provided an unmodified (“clean”) audit opinion on both standalone and consolidated financial results for Q1 FY26, confirming that the results present a true and fair view according to applicable accounting standards and regulations.

Standalone Financial Results Snapshot (₹ crore)

| Particulars | Q1 FY26 (June 30, 2025) | Q4 FY25 (Mar 31, 2025) | Q1 FY25 (June 30, 2024) | FY25 (Year End) |

|---|---|---|---|---|

| Revenue from operations | 35,275 | 34,136 | 33,283 | 136,592 |

| Profit before tax | 8,660 | 9,061 | 8,128 | 35,441 |

| Profit for the period | 6,114 | 6,628 | 5,768 | 25,568 |

| Basic EPS (₹/share) | 14.72 | 15.96 | 13.90 | 61.58 |

| Diluted EPS (₹/share) | 14.70 | 15.93 | 13.87 | 61.46 |

Commentary

- Revenue Growth: Infosys reported a 7.6% increase in consolidated revenue YoY for Q1 FY26.

- Profitability: The profit for the quarter grew by 8.6% YoY. Margins remained resilient despite ongoing challenges in the global macro environment.

- Shareholder Returns: Infosys remains committed to shareholder rewards as reflected in substantial dividend payouts.

- Investments and Acquisitions: Strategic acquisitions in consulting and cybersecurity strengthened Infosys’ capabilities and geographic presence.

- Risks: While financial performance is stable, some uncertainty persists due to ongoing regulatory inquiries in the U.S.

Conclusion

Infosys started FY26 on a strong note, showing robust financials, driving business growth across key industry segments, and actively pursuing strategic acquisitions. The focus on digital, consulting, and cybersecurity, coupled with prudent financial management, positions Infosys well for continued success—though close attention to regulatory developments remains prudent.

All financial data are extracted from Infosys’ Q1 FY26 audited results and official statements dated July 23, 2025.

- Open Demat account using:

- Upstox: https://upstox.onelink.me/0H1s/2QBH4Y

- Zerodha: https://zerodha.com/open-account?c=UI9061

- FundsIndia: https://www.fundsindia.com/registration/signup?referrer=14c986bdd27841eabe42ce2aaa37815b