Introduction

When it comes to building wealth, it’s not just about picking the right stocks or chasing high returns. The real game-changer is asset allocation—the art of deciding how much of your money goes into different types of investments. Why? Because the right asset allocation balances risk and reward, ensuring your financial plan works in both good and bad markets.

What is Asset Allocation and Why Does It Matter?

Asset allocation is the process of dividing your investments among various asset classes—equity, debt, cash, and alternatives—based on your goals, time horizon, and risk tolerance.

Why it’s important:

- Risk Management: Spreads your investments to minimize losses during market downturns.

- Consistency: Provides stability and reduces emotional investing decisions.

- Growth with Safety: Balances wealth creation with capital protection.

Key Asset Classes You Need to Know

- Equity (Stocks, Mutual Funds): High-risk, high-return asset class suitable for long-term goals.

- Debt (Bonds, Fixed Deposits): Provides stability and regular income with lower risk.

- Cash & Cash Equivalents: Offers liquidity but low returns.

- Alternative Assets (Gold, Real Estate, REITs): Hedge against inflation and market volatility.

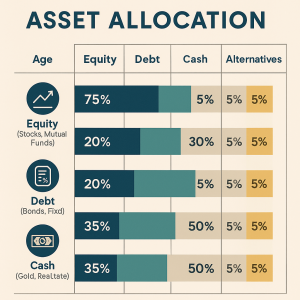

How to Decide Your Asset Allocation

Your allocation depends on:

- Age: Younger investors can take more equity exposure, while retirees should stick to safer assets.

- Rule of 100 (or 110):

Equity % = 100 – Your Age

Example: If you’re 30, then 70% in equities and 30% in debt & others. - Financial Goals: Short-term goals → Debt-heavy; Long-term goals → Equity-heavy.

- Risk Appetite: Aggressive vs conservative investors.

Popular Asset Allocation Strategies

- 60:40 Portfolio: 60% equity, 40% debt (for moderate risk takers).

- Aggressive Allocation: 80% equity, 20% debt (for young investors).

- Conservative Allocation: 30% equity, 70% debt (for retirees).

- Dynamic Allocation: Adjust equity/debt based on market conditions using Balanced Advantage Funds.

Mistakes to Avoid

- Putting all money in one asset class (over-concentration).

- Ignoring periodic rebalancing.

- Chasing short-term returns and ignoring risk.

How to Implement Asset Allocation

- Mutual Funds: Use hybrid or balanced advantage funds for automatic rebalancing.

- Hybrid funds, also known as Balanced Advantage Funds, invest in a mix of equity and debt instruments. The biggest advantage is automatic rebalancing.

When markets are high, these funds reduce equity exposure and increase debt allocation to safeguard returns. Conversely, during market corrections, they raise equity exposure to capture future growth. This strategy reduces emotional decision-making and helps maintain a stable risk profile without constant manual intervention.

Ideal for: Investors seeking stability, moderate returns, and minimal involvement in portfolio management.

- Hybrid funds, also known as Balanced Advantage Funds, invest in a mix of equity and debt instruments. The biggest advantage is automatic rebalancing.

- ETFs & Index Funds: For low-cost diversification.

- Exchange Traded Funds (ETFs) and Index Funds are passive investment options designed to mirror a market index like Nifty 50 or Sensex. Their biggest advantage is low expense ratio, meaning you pay less for management fees compared to actively managed funds.

They provide instant diversification across sectors and companies, making them perfect for investors who believe in the “market average” approach rather than chasing high-performing stocks.

Ideal for: Cost-conscious investors and those who prefer a hands-off approach.

- Exchange Traded Funds (ETFs) and Index Funds are passive investment options designed to mirror a market index like Nifty 50 or Sensex. Their biggest advantage is low expense ratio, meaning you pay less for management fees compared to actively managed funds.

- Direct Investments: For DIY investors managing equity and bonds separately.

- For experienced investors, direct allocation into stocks and bonds offers the highest control and customization. This approach allows you to design your own asset allocation strategy—for example, 70% equity and 30% debt—and rebalance manually as market conditions change.

However, it demands time, research, and discipline. A DIY approach exposes you to higher risk if not monitored properly, but it can also yield better returns if executed well.

Ideal for: Seasoned investors comfortable with volatility and decision-making.

- For experienced investors, direct allocation into stocks and bonds offers the highest control and customization. This approach allows you to design your own asset allocation strategy—for example, 70% equity and 30% debt—and rebalance manually as market conditions change.

Rebalancing: The Final Step

Even the perfect plan needs a check-up. Market fluctuations can skew your allocation, so review your portfolio annually and rebalance to maintain your desired mix.

Conclusion

Asset allocation isn’t just a concept—it’s the cornerstone of successful investing. A well-diversified portfolio ensures you stay on track, even when markets fluctuate. Focus on discipline, not speculation, and watch your wealth grow steadily.

Let me know in the comment section if you need detailed blog on any topic

Open Demat account using:

Upstox: https://upstox.onelink.me/0H1s/2QBH4Y

Zerodha: https://zerodha.com/open-account?c=UI9061

FundsIndia: https://www.fundsindia.com/registration/signup?referrer=14c986bdd27841eabe42ce2aaa37815b