Introduction

In the world of personal finance, index funds have gained immense popularity among Indian investors due to their low costs, simplicity, and consistent returns. With growing awareness about passive investing, many are now turning to index funds as a core part of their wealth-building strategy.

In this complete guide, we’ll break down:

✅ What are index funds?

✅ The best-performing index funds in India (2025 update)

✅ How to choose the right index fund for your goals

✅ FAQs to help you get started

What is an Index Fund?

An index fund is a type of mutual fund or ETF that aims to replicate the performance of a specific market index—such as the Nifty 50 or Sensex—rather than trying to beat it.

- Passive investing: No active fund manager picking stocks

- Low expense ratio: Typically much cheaper than actively managed funds

- Market-matching returns: Delivers returns similar to the chosen index

Why Choose Index Funds in 2025?

- Cost Advantage: Lower fees = higher long-term returns

- Consistent Performance: Index funds outperform many active funds over time

- Diversification: Exposure to 50–100+ top companies with a single investment

- Simplicity: No need to track market timing or fund manager decisions

👉 For personal finance beginners, index funds are one of the easiest and most efficient ways to start investing.

Top Performing Index Funds in India (2025)

| Fund Name | 1-Year Return | 3-Year CAGR | Expense Ratio |

|---|---|---|---|

| Nippon India Nifty 50 Index Fund | ~22% | ~17% | 0.20% |

| HDFC Index Fund – Nifty 50 Plan | ~21% | ~16.5% | 0.30% |

| UTI Nifty Next 50 Index Fund | ~28% | ~19% | 0.35% |

| ICICI Prudential Nifty Next 50 Index Fund | ~27% | ~18.5% | 0.32% |

| Mirae Asset Nifty 50 ETF | ~22% | ~17% | 0.05% |

(Returns as of mid-2025. Past performance doesn’t guarantee future results.)

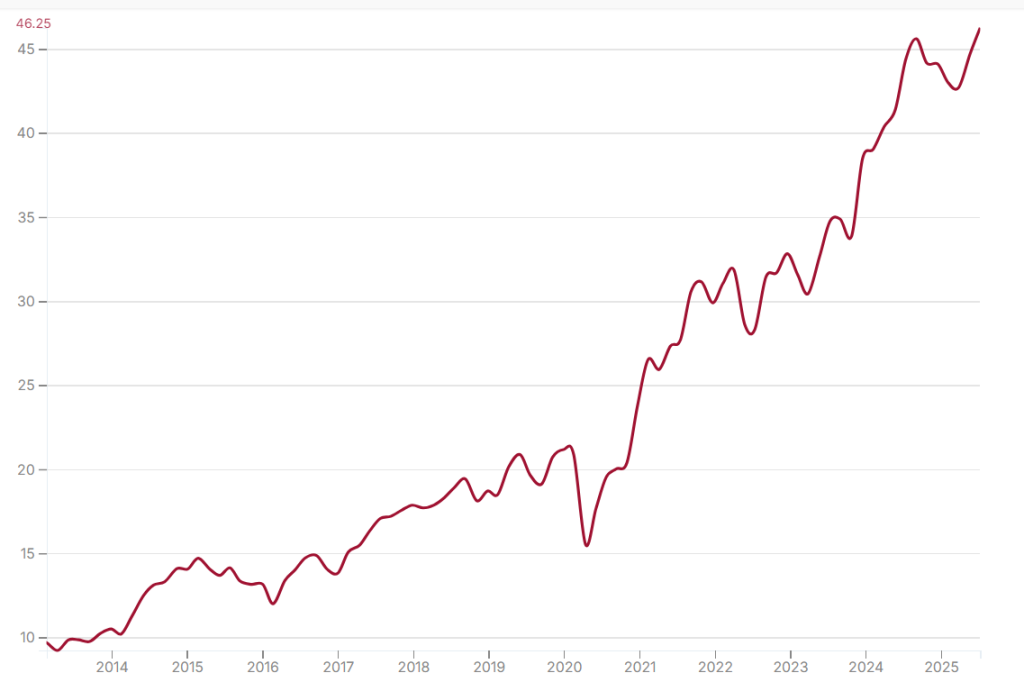

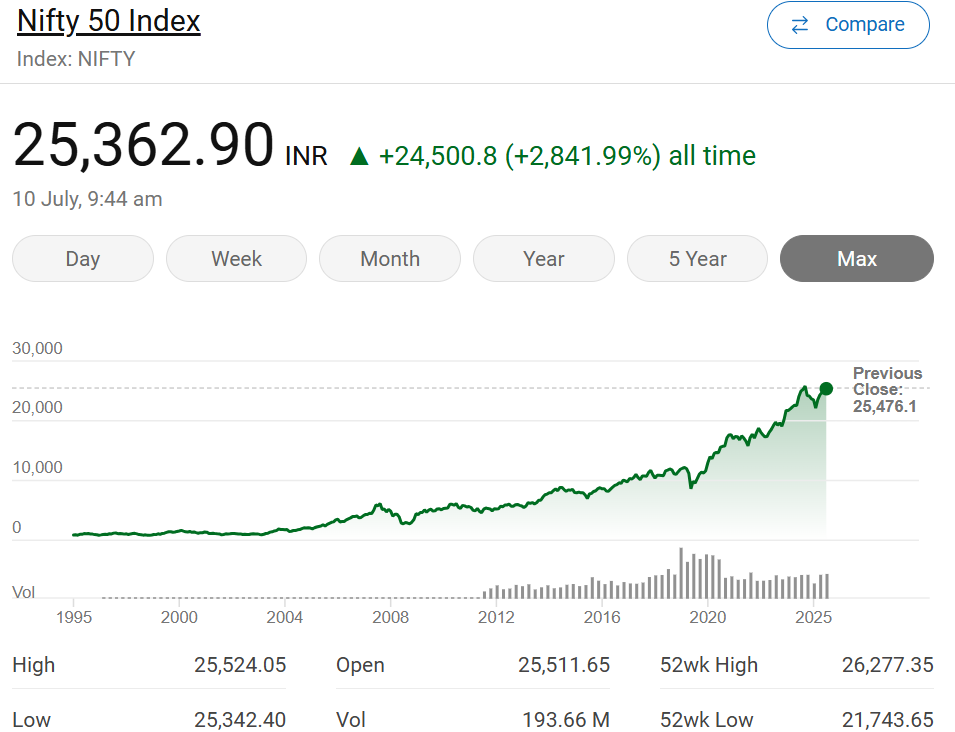

Index Fund vs Major Market Indices

Index fund are passive investment vehicles designed to mirror the performance of major market indices such as the Nifty 50, Sensex, or Nifty Next 50. While indices represent a broad market snapshot, index funds enable investors to gain exposure to these indices with minimal cost and effort. The returns of index funds closely track the respective indices, typically lagging slightly due to expense ratios. Unlike actively managed funds, index funds don’t aim to outperform the market but rather match its performance, making them ideal for long-term wealth building with lower fees and reduced volatility.

How to Select the Right Index Fund?

Choose the Right Index:

- Nifty 50: Large-cap stability

- Nifty Next 50: Higher growth potential with mid-large caps

- Sensex: Top 30 stable companies

Check Expense Ratio: Lower is better in passive funds.

Track Fund Size (AUM): Larger AUM reflects trust and stability.

Investment Horizon:

- Short-term (1–3 yrs): Consider balanced funds.

- Long-term (5+ yrs): Nifty or Sensex index funds can create real wealth.

Example: SIP in Index Fund

Investing ₹5,000/month in a Nifty 50 Index Fund with ~12% average return could grow to:

- ₹3.5 lakhs in 5 years

- ₹10+ lakhs in 10 years

Explore this idea in more detail in our post:

Saving ₹100 a Day Can Create ₹1 Crore Wealth

FAQs on Index Funds in India

Q1. Are index funds safe?

A: They carry market risk but are considered safer than individual stocks.

Q2. What is the best time to invest?

A: Start early and stay invested timing the market isn’t necessary.

Q3. How much should I invest?

A: Start with what you can afford (even ₹500/month) and increase as your income grows.

🎯 Conclusion: Is an Index Fund Right for You?

If you value:

- Low cost

- Market-matching performance

- Long-term growth

- Simplicity

…then index funds deserve a place in your personal finance plan in 2025 and beyond.

👉 Next Steps:

- Open a free account on Zerodha Coin or Groww

- Start a monthly SIP in an index fund

- Keep investing and watch your wealth grow 🚀

Pingback: NSDL IPO 2025: 7 Must-Know Insights Before You Invest in India’s Financial Backbone - Wealthy Wisdom