What Are ESOPs?

Employee Stock Option Plans (ESOPs) allow employees to buy company shares at a pre-determined price, usually lower than the market price, as a reward for loyalty and performance.

While ESOPs are a great wealth-building tool, many employees make mistakes while filing their ITR, leading to penalties and notices from the Income Tax Department.

When Are ESOPs Taxed?

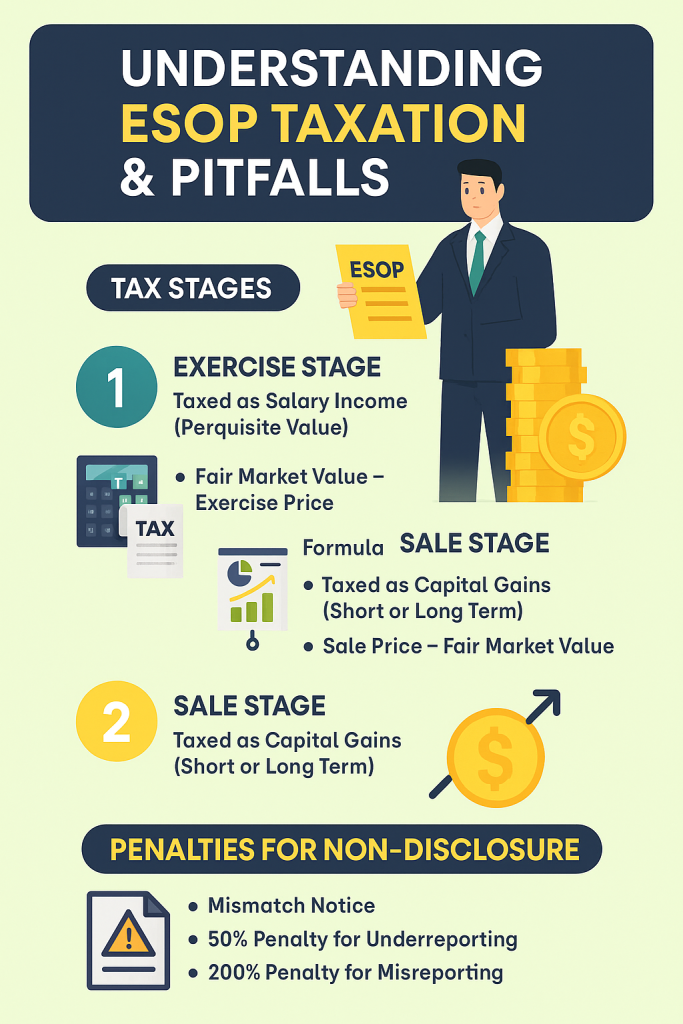

ESOPs are taxed twice in India:

1. At the Time of Exercise (Buying the Shares)

- Taxed as Salary Income (Perquisite).

- Formula:

Perquisite Value = FMV on Exercise Date – Exercise Price - Taxed as per your income tax slab.

- Employer deducts TDS on this amount.

Example:

- FMV: ₹500 per share

- Exercise Price: ₹100 per share

- No. of Shares: 100

- Perquisite Value: ₹(500 – 100) × 100 = ₹40,000

This ₹40,000 is added to your salary and taxed accordingly.

2. At the Time of Sale

- Capital Gains Tax applies.

- Formula:

Capital Gain = Sale Price – FMV on Exercise Date - Holding Period Matters:

- Listed Shares:

- Short Term (<12 months): 15% tax

- Long Term (≥12 months): 10% on gains above ₹1 lakh

- Unlisted Shares:

- Short Term (<24 months): Taxed as per slab

- Long Term (≥24 months): 20% with indexation

- Listed Shares:

Example:

- Sale Price: ₹800 per share

- FMV at Exercise: ₹500

- Capital Gain: ₹(800 – 500) × 100 = ₹30,000

Tax: 15% (if short-term) = ₹4,500

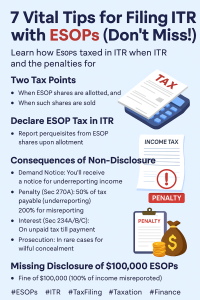

Things to Remember While Filing ITR

- Always include ESOP perquisite value under ‘Salary Income’.

- Report Capital Gains separately under Schedule CG.

- Cross-check with Form 16, AIS, and 26AS.

What Happens If You Don’t Declare ESOPs?

1. Mismatch in AIS & ITR

- IT department gets ESOP details from employer and brokers.

- If you skip, your return may get flagged.

2. Possible Penalties & Consequences

2.1 Demand Notice

If you fail to declare ESOP income in your ITR, the Income Tax Department will detect the discrepancy during assessment or through data from your employer (Form 16 / Form 12BA).

- What happens:

You’ll receive a demand notice under Section 143(1) or a notice for underreporting income under Section 148 or 139(9). - Implication:

This means your return is either considered defective or reassessed with additional tax liability.

2.2 Penalty (Section 270A)

If you do not report ESOP-related perquisites or gains, it is treated as underreporting or misreporting of income:

- Underreporting:

- Penalty = 50% of the tax payable on the unreported income.

- Example: If ESOP taxable amount is ₹5,00,000 and tax rate is 30% = ₹1,50,000 tax.

Penalty = ₹75,000 (50% of tax).

- Misreporting (willful misrepresentation):

- Penalty = 200% of the tax payable.

- Example: If same case is treated as misreporting, penalty = ₹3,00,000.

2.3. Interest (Sections 234A/B/C)

Interest is levied for delay in tax payment:

- 234A: Delay in filing ITR = 1% per month on unpaid tax.

- 234B: If 90% of advance tax not paid = 1% per month till full payment.

- 234C: For deferment of advance tax = interest on installment shortfall.

- Example: If tax ₹1,50,000 unpaid for 6 months = ₹9,000 interest (approx.).

2.4 Prosecution

In rare cases of willful concealment, prosecution under Section 276C can apply:

- Imprisonment: 3 months to 7 years + fine.

- Usually applies for large tax evasion (over ₹25 lakh or deliberate fraud).

Example of Fine Calculation

- Tax payable on undisclosed ESOP income: ₹50,000

- Penalty (50%): ₹25,000

- Interest (approx.): ₹5,000–₹8,000

Total Additional Burden: ₹30,000+

How to Avoid These Penalties?

- Disclose ESOP perquisite in ‘Income from Salary’ section.

- Add Capital Gains under Schedule CG.

- Use your Form 16, Broker Statements, and AIS as reference.

Quick Checklist for ESOP Reporting

✔ Report Perquisite Value (Form 16)

✔ Include Capital Gains (if sold shares)

✔ Pay Advance Tax (if applicable)

✔ Verify with AIS & Form 26AS

Bottom Line

ESOPs can be a great wealth-building tool, but tax reporting errors can lead to huge penalties and unnecessary stress. Always disclose ESOP income and gains accurately while filing your ITR.