Mutual funds basics were introduced in our previous blog post.

Did you know that mutual funds charge a fee from investors?

If you redeem your mutual fund units before completing the required holding period, you may be charged an additional fee called an exit load, which can be a percentage of your investment.

In this post, we’ll dive deeper into how mutual funds work, breaking down important terms like NAV (Net Asset Value), Exit Load, and the Expense Ratio — all explained with simple, real-life examples to help you make better investment decisions.

What is NAV in Mutual Funds?

NAV, or Net Asset Value, is the price of a single unit of a mutual fund at a given point in time. It helps investors understand how much they are paying to invest in the fund.

✅ Simple Definition:

NAV = (Total Assets – Total Liabilities) ÷ Total Number of Units

It’s calculated at the end of every trading day and reflects the per-unit value of the mutual fund’s holdings.

💡 Example:

Let’s say a mutual fund has:

- ₹10 crore worth of stocks and cash (total assets),

- ₹50 lakh in expenses and liabilities,

- 5 lakh units issued to investors.

NAV = (10,00,00,000 – 50,00,000) ÷ 5,00,000 = ₹190 per unit

So, if you invest ₹19,000, you’ll receive 100 units of this mutual fund (₹19,000 ÷ ₹190).

📝 Important Notes:

- NAV is not a profit or performance indicator — it’s just the unit price.

- A lower NAV doesn’t mean cheaper or better — it simply means each unit costs less, like the difference between a ₹10 biscuit pack vs ₹100 family pack.

- Returns are based on NAV appreciation over time, not on the starting NAV.

🎯 Key Takeaway:

Think of NAV as the “price tag” of mutual fund units. The actual performance depends on how much the NAV grows over time.

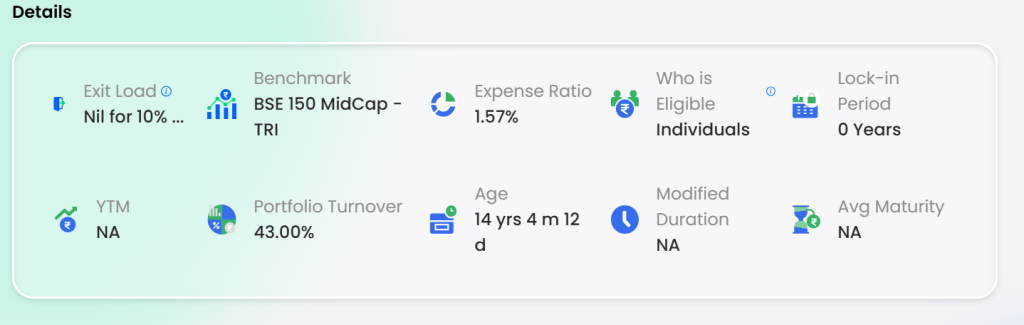

🚪What is Exit load?

Exit Load is a fee or penalty charged by mutual fund companies when an investor redeems (sells) their units before a specified holding period. It is designed to discourage early withdrawals and maintain fund stability.

✅ Simple Definition:

Exit Load = A percentage of the total value of units you are redeeming, deducted if you withdraw before the lock-in or minimum holding period.

💡 Example:

Let’s say you invested ₹1,00,000 in a mutual fund with:

- Exit Load: 1% if redeemed within 12 months

- Current NAV after 6 months = ₹120

- You decide to redeem your investment, and it has grown to ₹1,20,000.

Since you’re redeeming before 12 months, the fund will charge 1% exit load:

- Exit Load = 1% of ₹1,20,000 = ₹1,200

- You will receive = ₹1,20,000 – ₹1,200 = ₹1,18,800

📌 Key Points to Remember:

- Exit Load is NOT charged if you redeem after the specified period (e.g., after 12 months).

- Different funds have different exit load structures — always read the fund’s terms.

- Equity funds often have a 1% exit load for redemptions before 1 year.

- Debt funds may have varied or no exit load, depending on duration.

🎯 Key Takeaway:

Exit Load can reduce your final returns if you withdraw too early. Always check the exit load policy before investing and plan your investments with the right time horizon.

💰 What is Expense Ratio in Mutual Funds?

Expense Ratio is the annual fee that a mutual fund house charges you for managing your investment. It includes costs like fund management fees, administrative expenses, distribution, and other operational charges.

In short, it’s what you pay the fund house every year for handling your money — even if you don’t actively buy or sell units.

🧮 How is Expense Ratio Calculated?

Expense Ratio (%) = Total Annual Expenses of the Fund ÷ Average Assets Under Management (AUM)

It’s expressed as a percentage of your investment amount and is deducted daily from the fund’s assets before calculating NAV. That’s why you don’t see it as a separate charge — it’s built into your returns.

💡 Example:

Let’s say you invest ₹1,00,000 in a mutual fund with:

- Expense Ratio = 1.5%

- Annual return (before expenses) = 10%

The actual return you’ll receive = 10% – 1.5% = 8.5%

So, your total return for the year:

- Without Expense Ratio: ₹1,00,000 × 10% = ₹10,000

- With Expense Ratio: ₹1,00,000 × 8.5% = ₹8,500

- ₹1,500 is deducted as expense

📌 Key Points to Know:

- Lower Expense Ratio = Better for Long-Term Returns

- Especially important for index funds and debt funds.

- Actively managed funds tend to have higher expense ratios (1%–2.5%)

- Passively managed funds (e.g., index funds) usually have lower expense ratios (as low as 0.1%)

🎯 Why It Matters:

Even a small difference in expense ratio can impact your wealth in the long run. For example, a 1% difference over 20 years can mean lakhs of rupees in missed gains for large investments.

✅ Key Takeaway:

Expense Ratio quietly eats into your returns every day. Choose mutual funds with a balanced mix of performance and cost — especially if you’re investing for the long term.

I am providing an external link to check these values from Funds India broker: https://www.fundsindia.com/s/axis-midcap-fund-reg-g-/13049

Coming Up Next: Did you know there are mutual funds with much lower Exit Loads and Expense Ratios? We’ll dive into these smarter investment choices in our next blog.

Open Demat account using:

Upstox: https://upstox.onelink.me/0H1s/2QBH4Y

Zerodha: https://zerodha.com/open-account?c=UI9061

FundsIndia:https://www.fundsindia.com/registration/signup?referrer=14c986bdd27841eabe42ce2aaa37815b

Very well explained.. keep going..

Thank you, Apoorva.