In our earlier blogs we have talked about the mutual funds basics and the charges associated with mutual funds. In this blog we will talk about one of a kind mutual fund which is Index Funds.

In recent years, Index Funds have gained immense popularity among Indian investors who seek simplicity, lower costs, and long-term returns. But what exactly are index funds, and why are they becoming an essential part of smart investing strategies?

What Are Index Funds?

Index funds are mutual funds or ETFs that replicate the performance of a specific market index. Instead of actively selecting stocks, these funds passively track an index such as the Nifty 50, Sensex, or S&P 500, investing in the same stocks in the same proportion.

Key benefits:

- Lower expense ratio (as low as 0.1%)

- Diversified exposure

- Suitable for long-term, passive investors

Index Funds Categorization

1.Based on Index type

| Category | Example | Description |

| Broad market Index Funds | Nifty 50, Sensex | Tracks the top 50 or 30 companies in India |

| Mid Cap/Small Cap Funds | Nifty Next 50, Nifty Midcap 150 | Capture growth from mid-sized or emerging companies |

| Sectoral/Thematic Index Funds | Nifty IT, Nifty Bank, Nifty Fin etc.. | Focus on specific industries like banking or technology |

| Global Index Funds | S&P 500, Nasdaq 100 | Provide international exposure to US markets |

2.Based on Structure

In this category Index funds are categorized based on how they are bought and sold or traded.

- Index Mutual Funds

- Equity Traded Funds (ETF)

Index Mutual Funds

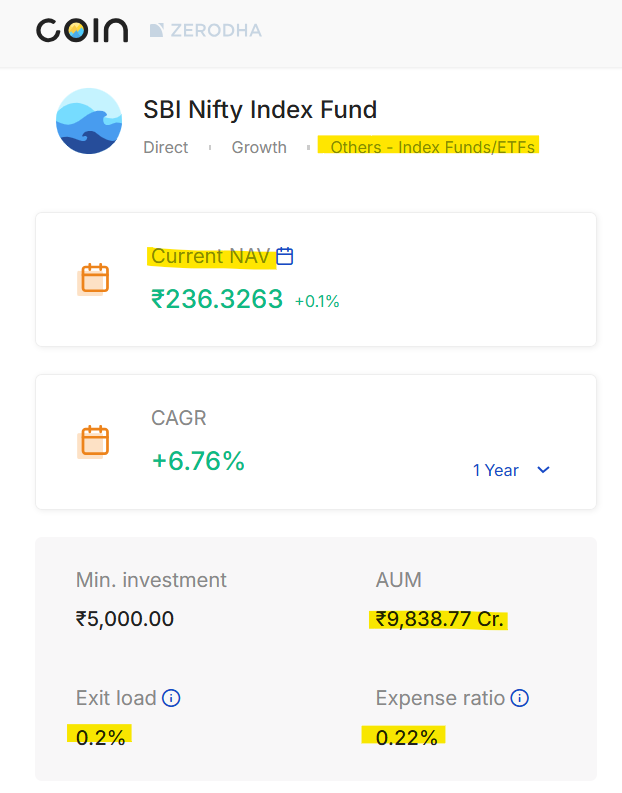

Index Mutual Funds are managed and transacted directly through an Asset Management Company (AMC), rather than being traded on the stock exchange. Investors can buy or redeem units by placing requests with the AMC, either online or through distributors. The Net Asset Value (NAV), which determines the unit price of the fund, is calculated and published only once per day — typically at the end of the trading session. This means all buy/sell transactions in index mutual funds are processed based on the same daily NAV, offering transparency but no intraday pricing.

Sample: https://coin.zerodha.com/mf/fund/INF200K01TE8/sbi-nifty-index-fund-direct-growth

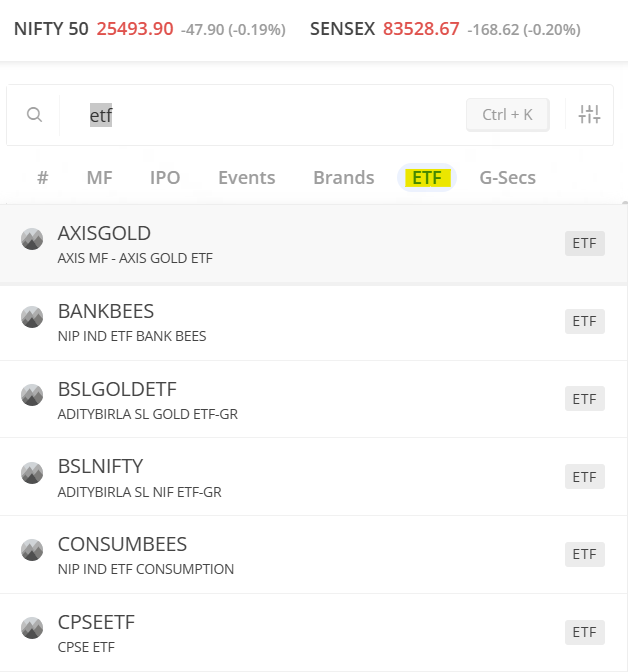

Equity Traded Funds

Exchange-Traded Funds (ETFs) are a type of index fund that are bought and sold on stock exchanges just like individual shares. Unlike traditional mutual funds, where transactions are processed once a day at the NAV, ETFs allow investors to trade throughout the day at market-determined prices. This means the price of an ETF constantly fluctuates in real-time based on supply and demand — offering better flexibility, liquidity, and the potential to buy at a desired price point.

However, to invest in ETFs, you must have a Demat account and a trading account with a broker, since transactions happen through the stock exchange. ETFs are ideal for investors who want real-time access to index fund investing along with the ability to time their entries and exits.

Key Uses and Benefits of Index Funds

1. Low-Cost Wealth Creation

With expense ratios often below 0.5%, index funds cost significantly less than active funds, maximizing your long-term returns.

2. Market-Matching Performance

They aim to match the market’s returns instead of trying to beat it. Over time, they often outperform actively managed funds due to consistency and lower fees.

3. Diversification Made Easy

One index fund investment can offer exposure to 50 or more companies, reducing individual stock risk.

4. Ideal for Beginners

Requires minimal research or monitoring. Just set up a SIP and stay invested long term.

5. Global Diversification

Funds tracking the S&P 500 or Nasdaq 100 offer easy entry into international equity markets for Indian investors.

Things to Keep in Mind

- Index funds don’t offer protection during market downturns

- Returns are capped at the index performance

- There can be minor tracking errors

Final Thoughts

Index funds are a fantastic option for building a cost-effective, diversified, and long-term investment portfolio. Whether you’re a beginner or an experienced investor looking for low-maintenance growth, adding index funds to your mix is a smart move.

Pro Tip: Start with a Nifty 50 or S&P 500 index fund and build your portfolio around it. Over time, you can add midcap, sectoral, or international exposure based on your goals.

Stay tuned for our next blog on “Top Performing Index Funds in India for 2025.”

Happy Investing!

Open Demat account using:

Upstox: https://upstox.onelink.me/0H1s/2QBH4Y

Zerodha: https://zerodha.com/open-account?c=UI9061

FundsIndia:https://www.fundsindia.com/registration/signup?referrer=14c986bdd27841eabe42ce2aaa37815b