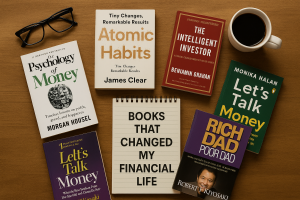

Reading isn’t just a habit — it’s an investment. Over the years, certain books have completely reshaped how I think about money, time, habits, and long-term wealth. These aren’t just finance guides; they’re mindset-shifting tools that anyone can benefit from.

Here are the top 5 books that truly changed my financial life — and why you should consider reading them too.

1. 💸 The Psychology of Money by Morgan Housel

Lesson: Wealth is not just about knowledge — it’s about behavior.

This is hands-down one of the most relatable and eye-opening finance books ever written. Housel doesn’t lecture — he tells stories. The key takeaway? You don’t need to be brilliant to be wealthy. You just need to be consistent and emotionally intelligent.

Why it changed my life:

It helped me stop comparing my journey with others and start focusing on saving and patience over flashy investing.

2. Atomic Habits by James Clear

Lesson: Small changes compound into massive results.

Though not a finance book in the traditional sense, this book transformed the way I manage money. Clear’s principle of “1% improvement daily” made me realize that automating SIPs, tracking expenses, or reviewing goals once a week is all it takes to build wealth slowly and surely.

My favorite idea: “You do not rise to the level of your goals. You fall to the level of your systems.”

3. The Intelligent Investor by Benjamin Graham

Lesson: Investing is about temperament, not timing.

A timeless classic. While dense in some parts, this book laid the foundation for long-term, value-based investing. Warren Buffett calls it the best investing book ever written — and for good reason.

What I learned: Avoid speculation. Focus on the intrinsic value of businesses and don’t let market noise sway your strategy.

Pro tip: Start with the annotated edition with Jason Zweig’s commentary — it makes complex concepts easier.

🔗 Get The Intelligent Investor

4. Let’s Talk Money by Monika Halan

Lesson: Personal finance isn’t complex — we just avoid it.

This India-specific guide helped me structure my savings, insurance, and investments into an easy-to-manage system. It’s practical, non-jargon-heavy, and perfect for working professionals and beginners alike.

Impact on me: This book taught me how to automate my salary split — 30% to savings, 20% to investments, and the rest for guilt-free spending.

🔗 Buy Let’s Talk Money on Amazon

5. Rich Dad Poor Dad by Robert Kiyosaki

Lesson: The rich don’t work for money — they make money work for them.

This is often the first “aha!” book for many. While it’s a bit dramatized, it teaches core ideas like assets vs. liabilities, the importance of cash flow, and financial independence.

What stuck with me: Understanding the difference between earning income and building wealth — a lesson many professionals overlook.

Final Thoughts

Reading these books didn’t just help me understand money — they taught me how to respect it, use it wisely, and build towards freedom. If you’ve been looking for a starting point on your financial journey, let these books be your compass.

Start with one, build the habit, and let the mindset shift begin.

Bonus: Quick Recap Table

| Book Title | Author | Key Takeaway |

|---|---|---|

| The Psychology of Money | Morgan Housel | Money is behavior, not just math |

| Atomic Habits | James Clear | Small habits = long-term gains |

| The Intelligent Investor | Benjamin Graham | Invest with discipline and patience |

| Let’s Talk Money | Monika Halan | Personal finance made simple (for India) |

| Rich Dad Poor Dad | Robert Kiyosaki | Build assets, not liabilities |

Ready to Start Reading?

Explore these life-changing books on Amazon and start your transformation today:

The Psychology of Money: https://amzn.to/4ocV0XY

Atomic Habits : https://amzn.to/3UzVPfX

The Intelligent Investor : https://amzn.to/41hReTn

Let’s Talk Money by Monika Halan : https://amzn.to/3H54Zhx

Rich Dad Poor Dad by Robert Kiyosaki : https://amzn.to/45aqkOs

Open Demat account using: