Introduction: Trump Tariffs and Why They Matter for India

Trade tensions are back in the spotlight as former U.S. President Donald Trump renews his aggressive stance on tariffs. This time, India is one of the key nations in focus. With new Trump tariffs potentially taking effect soon, understanding their implications on India’s economy has never been more important.

In this blog, we’ll break down 5 key ways Trump tariffs could impact India, and why businesses, policymakers, and investors should pay close attention.

What Are US Tariffs?

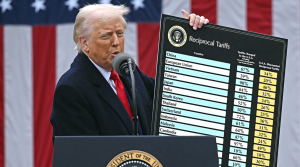

Trump tariffs refer to import taxes imposed by the United States under former President Donald Trump, aiming to protect American industries from foreign competition. While much of the focus has historically been on China, India is increasingly being drawn into these trade conflicts.

Recent discussions suggest tariffs could be applied to several Indian exports, including:

- Steel & Aluminium

- Automobile Components

- Pharmaceuticals

- Agricultural Products (such as rice and dairy)

These potential tariffs raise important questions for India’s economy and export-driven sectors.

1. Trump Tariffs Could Slow India’s GDP Growth

India’s direct exposure to the U.S. through goods exports is moderate, accounting for around 2% of India’s GDP. However, new US tariffs could still shave 0.2% to 0.5% off India’s annual growth, according to recent estimates by the Finance Ministry.

- 🔹 GDP Impact: Modest but notable

- 🔹 Sectors such as steel and pharma may face immediate pressure

By slowing exports, the Trump tariffs could affect manufacturing growth, employment, and foreign investment.

2. Trump Tariffs on Steel and Aluminium: A Direct Blow

One of the most vulnerable sectors is Steel & Aluminium. U.S. tariffs could reach as high as 50%, potentially making Indian exports less competitive in American markets.

| Sector | Risk Level | Impact Overview |

|---|---|---|

| Steel & Aluminium | High | Slowed exports, possible job losses |

| Auto Components | Medium | Costlier for U.S. buyers, demand decline |

| Pharmaceuticals | Medium | Price competition, regulatory hurdles |

| Agriculture | Low to Medium | Sensitive politically, limited direct impact |

3. Auto and Pharma Sectors Face Indirect Trump Tariff Risks

Though not always directly targeted, automobile components and pharmaceuticals could also suffer:

- Increased import costs for U.S. partners

- Competitive disadvantages compared to non-tariffed countries

These industries, while resilient, may need to explore alternative markets or shift supply chains to minimize exposure to Trump tariffs.

4. Opportunities Amid Trump Tariffs: India’s Silver Lining

Despite the risks, Trump tariffs could create new opportunities for India:

- Global Supply Chain Shifts: As companies move away from China, India can position itself as a strong alternative.

- Domestic Market Strength: India’s large and growing consumer base could help absorb shocks from reduced exports.

- Policy Reforms: Ongoing infrastructure and business reforms enhance India’s appeal to global investors.

India’s diversified economy provides resilience that can help soften the blow of any new Trump tariffs.

5. Strategic Risks: Navigating Uncertainty with Trump Tariffs

Finally, the biggest challenge lies in the unpredictability of future Trump tariffs:

- Tariff policies can change quickly, leaving businesses exposed.

- Any hasty trade agreements might disproportionately favor U.S. interests.

Beyond immediate economic impacts, strategic risks include the possibility of:

- Trade Dependency: Over-reliance on a single market (like the U.S.) could make India vulnerable to sudden policy shifts.

- Supply Chain Disruption: Companies heavily tied to U.S. demand may face unexpected operational challenges.

- Diplomatic Strain: Trade tensions can spill over into broader diplomatic relations, affecting cooperation in defense, technology, and geopolitical alignment.

- Investor Sentiment: Uncertainty could deter foreign direct investment, especially in export-driven sectors.

India needs to approach trade negotiations carefully, ensuring fair terms while safeguarding its economic sovereignty. A long-term diversification strategy—both in markets and sectors—will be essential to minimize future shocks from unpredictable tariff policies.

Conclusion: How India Can Navigate the Trump Tariff Era

The threat of Trump tariffs is real, but not insurmountable. With a balanced strategy that leverages India’s economic strengths, pushes forward on reforms, and carefully navigates trade deals, India can manage the risks and potentially emerge stronger.

As the August 1 deadline for new tariffs approaches, staying informed and agile will be key.

Open Demat account using:

Upstox: https://upstox.onelink.me/0H1s/2QBH4Y

Zerodha: https://zerodha.com/open-account?c=UI9061

FundsIndia:https://www.fundsindia.com/registration/signup?referrer=14c986bdd27841eabe42ce2aaa37815b