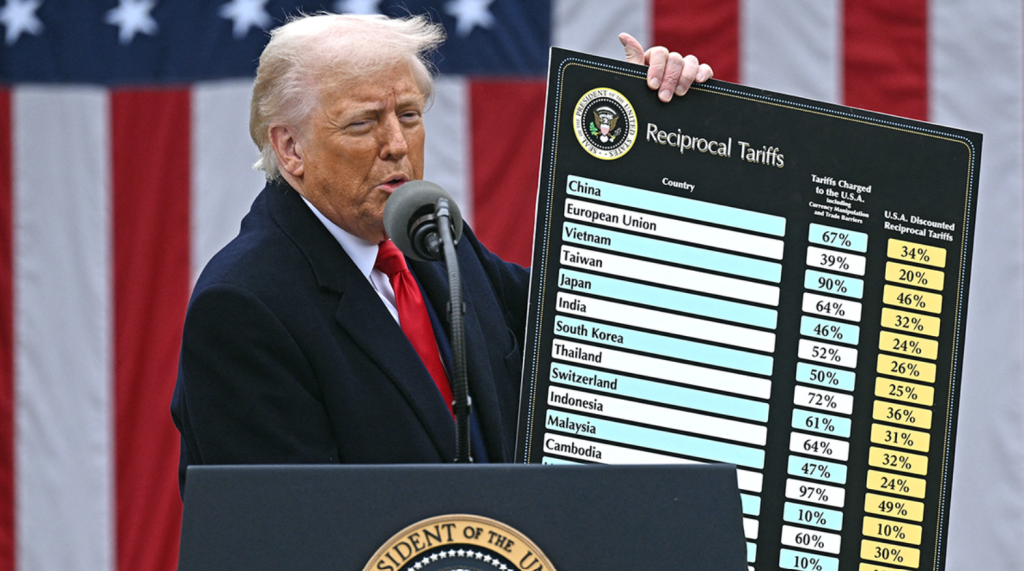

As the 2024 U.S. presidential race heats up, former President Donald Trump has revived his signature “America First” rhetoric—this time with direct implications for India. If re-elected, Trump plans to impose a 25% tariff on imports from countries that he believes are “cheating” the U.S., including India.

This bold move could reshape trade flows, disrupt export-heavy Indian sectors, and inject new volatility into the stock market. Here’s everything Indian investors, exporters, and policy-watchers need to know.

The 25% Tariff: Which Indian Sectors Are at Risk?

According to Trump’s recent remarks and campaign platform, the proposed 25% tariff would apply broadly to countries that have “massive trade surpluses” with the U.S. India, which exported over $78 billion worth of goods to the U.S. in FY24, is on that list.

Key sectors under threat:

| Sector | 2024 Export Value to U.S. | Risk Level |

|---|---|---|

| Pharmaceuticals | $8.5B | 🔺 High |

| Textiles & Apparel | $9.6B | 🔺 High |

| Engineering Goods | $17.2B | ⚠️ Medium |

| Gems & Jewelry | $11.9B | ⚠️ Medium |

| Steel & Aluminum | $2.8B | 🔴 Critical |

Such tariffs could lead to reduced competitiveness, supply chain disruptions, and even job losses across Indian manufacturing hubs.

CAATSA: Russian Defense Deals Under U.S. Watch

Trump’s tough stance doesn’t stop at trade. His administration (and the Biden administration after him) have previously expressed displeasure over India’s defense imports from Russia, including the S-400 missile system.

Under the CAATSA (Countering America’s Adversaries Through Sanctions Act), U.S. presidents can impose penalties on foreign entities engaging in significant defense transactions with Russia.

Impacted Entities Could Include:

- Indian Public Sector Units (PSUs) tied to defense

- Indian banks facilitating payments for these deals

- Suppliers in the defense manufacturing ecosystem

Though waivers have been granted in the past, a more aggressive second Trump term could reconsider that leniency.

What This Means for Indian Investors

If these tariffs and sanctions move forward, here’s how Indian markets might respond:

Pharma Stocks

- May face reduced margins and delayed exports

- Could be hit hard if generics pricing comes under pressure in the U.S.

Textiles & Apparel

- Tariff shock may force orders to shift to lower-cost nations like Vietnam or Bangladesh

- Exporters like Arvind, KPR Mills, and Welspun could face headwinds

Defense PSUs

- Stocks like HAL, BEL, and BEML may see knee-jerk volatility if sanctions become a risk

Foreign Institutional Investment (FII)

- Geopolitical instability could reduce FII flows into emerging markets like India

Rupee-Dollar Impact & Macroeconomic Implications

1. Currency Depreciation:

A 25% tariff on Indian exports—especially textiles, steel, and automotive components—would likely reduce foreign exchange inflows. With fewer dollars entering the economy through exports, demand for the dollar could outpace supply, causing the rupee to depreciate.

2. Widening Current Account Deficit (CAD):

Reduced export revenue, combined with India’s reliance on high-value imports like crude oil and semiconductors, may widen the CAD. A higher deficit can strain forex reserves and raise borrowing costs globally.

3. Rising Import Costs & Inflation:

A weaker rupee means higher prices for imported goods, including fuel, machinery, and electronics. This import-led inflation could filter into everyday prices—from transport to mobile phones—impacting household budgets and manufacturing competitiveness.

4. Volatile Capital Flows:

Trade instability may spook foreign investors, especially in equity and bond markets. FII outflows can exacerbate rupee volatility, triggering sharp short-term movements in the currency.

5. RBI’s Dilemma:

With inflation risk rising and a weaker rupee, the Reserve Bank of India (RBI) may find itself in a tough spot:

- Should it raise interest rates to protect the rupee?

- Or cut them to stimulate growth amid global slowdown fears?

This tug-of-war could delay rate actions, adding uncertainty to the investment environment.

What Can You Do as an Investor?

- Diversify your equity exposure: Avoid over-concentration in export-dependent sectors.

- Watch for defensive plays: Domestic-focused FMCG and utilities may outperform.

- Track geopolitical news closely: Stay alert for tariff announcements or diplomatic developments.

- Consider USD-hedged mutual funds or ETFs if you’re investing globally.

Final Thoughts

Trump’s aggressive trade policies could bring a seismic shift in global commerce, and India is squarely in the crosshairs. While these proposals are not yet law, their potential market impact is too significant to ignore.

For investors: Stay diversified, reduce short-term exposure to vulnerable sectors, and prepare for potential policy turbulence.

For exporters: Begin reworking supply chains, seek new markets, and monitor Washington closely.